how are rsus taxed in india

Before you understand the taxation of ESOPs and RSUs here are some key terms you must know. RSUs are gaining popularity in recent times.

A Guide To Restricted Stock Units Rsus And Divorce

Lets understand how ESOPs are taxed.

. For people who didnt know you can view page source for a non locked mode google form and. The terms are agreed upon between the employer and employee. 9000 Our premium archival inks produce images with.

PRNewswire -- Texas Instruments Incorporated TI Nasdaq. ESOP or Employee Stock Option Plan allows an employee to own equity shares of the employer company over a certain period of time. Got a call from Spectrum.

Restrictive Stock Units RSUs When the employer gives RSUs the employee gets the shares free of cost provided some conditions are met like a vesting period employment time-frame etc. For those who like the flow-through design. A high-quality curriculum no longer requires weeks of prep.

In addition the TCJA subjected us to a tax on our global intangible low-taxed income GILTI effective July 1 2018. Under GAAP we can make an accounting policy election to either treat taxes due on the GILTI inclusion as a current period expense or factor such amounts into our measurement of deferred taxes. I have new cartridges but havent tried them as it will print a scan.

519 the child tax credit or credit for other dependents. Not claim the child tax credit or credit for other dependents in Step 3 of Form W-4 if the nonresident alien is a resident of Canada Mexico or South Korea or a student from India or a business apprentice from India he or she may claim under certain circumstances see Pub. TXN today reported fourth quarter revenue of 483 billion net income of 214 billion and.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

How Restricted Stock And Restricted Stock Units Rsus Are Taxed Systematic Investment Plan Mutuals Funds Mutual Funds Investing

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

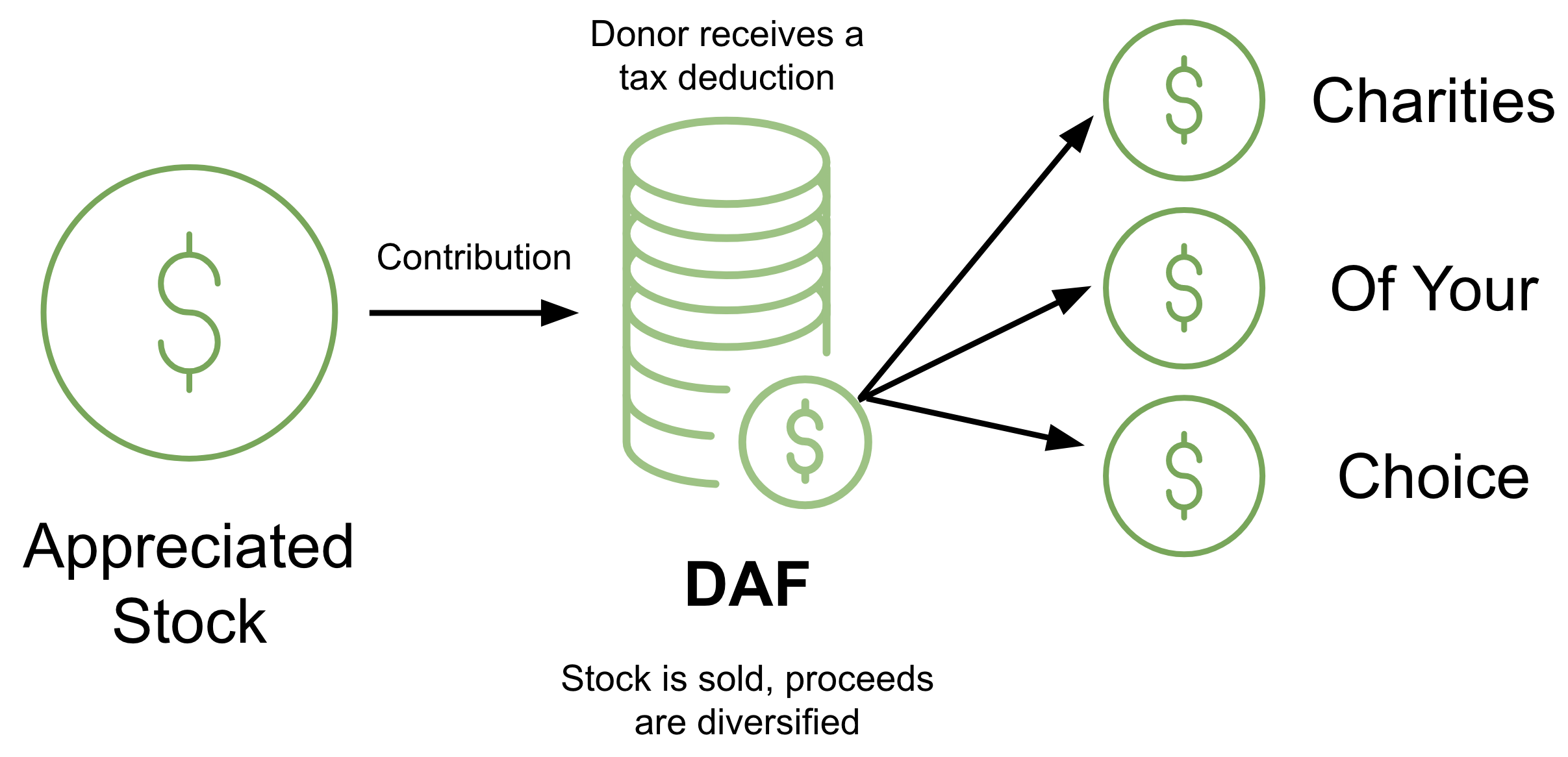

How To Avoid Taxes On Rsus Equity Ftw

Income Tax Implications On Rsus Or Espps

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Income Tax Implications On Rsus Or Espps

Restricted Stock Units Rsus In Friendly Terms Part 2 Of Equity Compensation Taxes Youtube

Stock Options Vs Rsus What S The Difference Thestreet

Rsus Vs Stock Options Intel And Airbnb Executive Compensation Workspan Magazine Workspan By Worldatwork

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog