closed end funds leverage risk

Before the financial crisis closed-end bond funds could access relatively cheap short-term funding through auction-rate preferred securities ARS. So because capital does not flow freely into and out of CEFs they are referred to as closed-end funds.

Ad Learn why mutual funds may not be tailored to meet your retirement needs.

. The liquidation of the fund. Closed-end fund historical distribution sources have included net investment income realized gains and return of capital. This article covers the basics of closed-end funds including the.

The closed-end structure gives rise to discounts and premiums. Get this must-read guide if you are considering investing in mutual funds. Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital.

This leverage can lead to higher returns for investors but it also makes losses more pronounced in down markets. Bold Trades on Broad and Diverse market sectors - 3X 2X 1X Leveraged and Inverse ETFs. Leverage magnifies returns both positively and negatively.

Structural leverage the most common type of. Closed-end funds will generally keep structural leverage between 20 to 40 of the value of its assets. The use of leverage is subject to risks including the potential for higher net asset value NAV and market price volatility and.

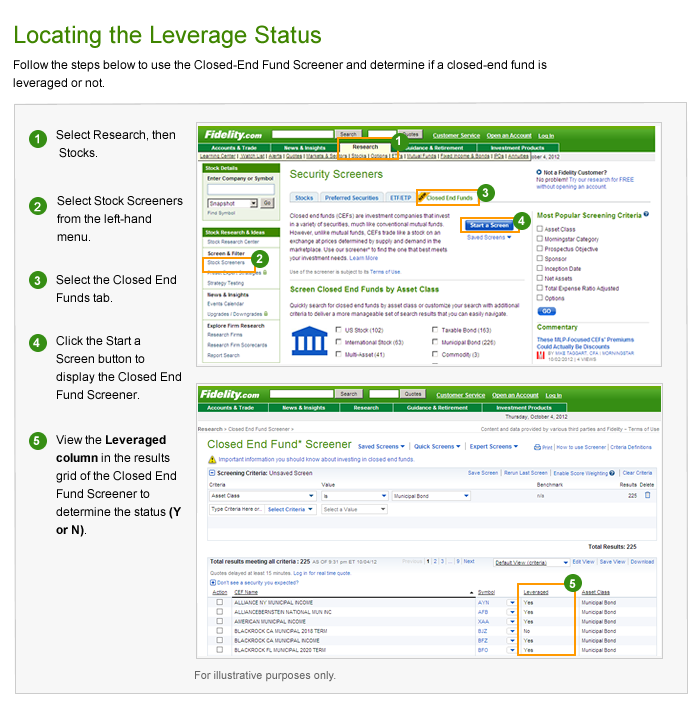

There can be no assurance that fund objectives will be achieved. Changes in interest rate levels can directly impact income generated by. See locating the leverage status using the closed-end fund screener for more information.

At the time roughly 72 of closed-end funds used leverage compared to 64 at the end of 2017 which investors feared would challenge the funds to roll over the debt and result in more expensive financing hurting returns. 10 Best Closed-End Funds. In many cases leverage in these assets is viewed as a foregone conclusion what investors must accept in exchange for 8-12 distributions.

Closed-end fund leverage can be classified as either structural leverage or portfolio leverage. Closed-end funds can produce higher income than open-end mutual funds. Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage.

To make leverage work a fund must be able to. This funding became expensive during the crisis when the ARS market collapsed. If you look at those three big risks in closed end funds.

Consider a bond fund. The first closed-end funds were. Costlier funding and negative bond returns during the crisis led to the funds most of which were near their allowed leverage maximum.

Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between 30 and 60. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can.

What Are the Dangers of Leveraged Closed-End Funds. Just like open-ended funds closed-end funds are subject to market movements and volatility. What is Leverage in a Closed-End Fund.

The use of leverage by a closed-end fund can allow it to achieve higher long-term returns but also increases the likelihood of share price volatility and market risk. This CEF has a leverage ratio of 50 computed as capital from preferred shares divided by net asset value. What are the risks associated with Closed-end Funds.

Structure has ability to buy illiquid assets with. Closed-end funds create leverage by borrowing at short-term rates then using that money to invest in strategies or instruments providing longer-term returns. For leveraged funds only forced sales to remain in compliance of leverage limits.

5 from preferred shares 10 in net asset value 50. Leverage is the use of borrowed money to get a greater return on your capital. Prudent investors focus on closed-end funds where the leverage is 35 or less.

What is Leverage in a Closed-End Fund. The value of a. The Funds use of leverage exposes the Fund to additional risks including the risk that the costs of leverage could exceed the income.

There are risks inherent in any investment including the possible loss of principal. Closed-end funds frequently trade at a discount to their net asset value. Closed-end funds create leverage by borrowing at short-term rates then using that money to invest in strategies or instruments providing longer-term returns.

What types of leverage do closed-end funds use. However CEF discounts and leverage serve as a double-edged sword that can cut investors particularly deep in bear markets. Closed-end funds have the ability to use leverage which can lead to greater risk but also greater rewards.

The leverage huge expense fees and uncertainty around the discount longer-term investors are usually better off with an ETF. Closed-end funds use of leverage can be relatively safe if the underlying assets are of high quality and have volatility of around 3 to 4 commensurate with stable assets such as high. Ad Pursue daily leveraged investment returns.

Daily Bull Bear ETFs.

5 Best High Yielding Closed End Funds To Buy

Guide To Closed End Funds Money For The Rest Of Us

5 Best High Yielding Closed End Funds To Buy

Investing In Closed End Funds Nuveen

Understanding Leverage In Closed End Funds Nuveen

Understanding Leverage In Closed End Funds Nuveen

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

A Lesson On Leverage In Municipal Bond Closed End Funds Vaneck

Guide To Closed End Funds Money For The Rest Of Us

Understanding Leverage In Closed End Funds Nuveen

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Rivernorth Doubleline Strategic Opportunity Fund Inc Opp Rivernorth

5 Best High Yielding Closed End Funds To Buy

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed End Fund Leverage Fidelity

Understanding Leverage In Closed End Funds Nuveen

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends